Why is WOO Network the most capital-efficient DEX? And is it worth Investing?

April 19, 2023

PEPE Token Price Increased 6000 Times, Is It Worth Investing in? Can I Buy it Now?

April 20, 2023Arbitrum VS Optimism, Which One is Worth Investing In?

As a leader in smart contracts, Ethereum’s earliest smart contracts had many unresolved issues. The biggest problem is the congestion on the Ethereum network, resulting in high gas prices and slower speeds. Currently, there are two ways to solve the problem of congestion on the Ethereum network: one is to solve it on layer 2. The other is to create another smart contract and completely abandon Ethereum. Arbitrum and Optimism are Ethereum’s layer 2 solutions.

1. What’s Layer 2 Solution?

The traditional processing method of blockchain requires every smart contract transaction to be queued and processed on the Ethereum mainnet, with higher gas fees required to prioritize processing. Currently, Ethereum can only process 15 transactions per second, which is very slow. If decentralized exchanges experience a surge in trading volume, slippage can become severe. Layer 2 is equivalent to scaling Ethereum, by processing those transactions before putting them on the mainnet, and then updating the processed data on the Ethereum mainnet. It’s like originally having to queue at a bank to withdraw and deposit money, but now being able to do it at an ATM.

Using Ethereum Layer 2 processing, solutions like Arbitrum and Optimism can process 2,000-4,000 transactions per second, and theoretically, gas fees can be reduced to 1/2000. With Ethereum’s upgrade, Layer 2 Roll up processing can achieve 100,000 transactions per second.

2. Arbitrum VS Optimism, The Differences

2.1 Single-Round Fraud Proof vs. Multi-Round Fraud Proof

Optimism uses single-round fraud proof, while Arbitrum uses multi-round fraud proof. The difference is that in the case of a disputed smart contract, Optimism’s single-round fraud proof will recalculate the block, while Arbitrum splits the block for calculation. Calculating the entire block is more expensive and single-round fraud proof relies on Layer 1 calculations, which can lead to fraud proof attacks. This makes Arbitrum’s multi-round fraud proof more secure and advanced.

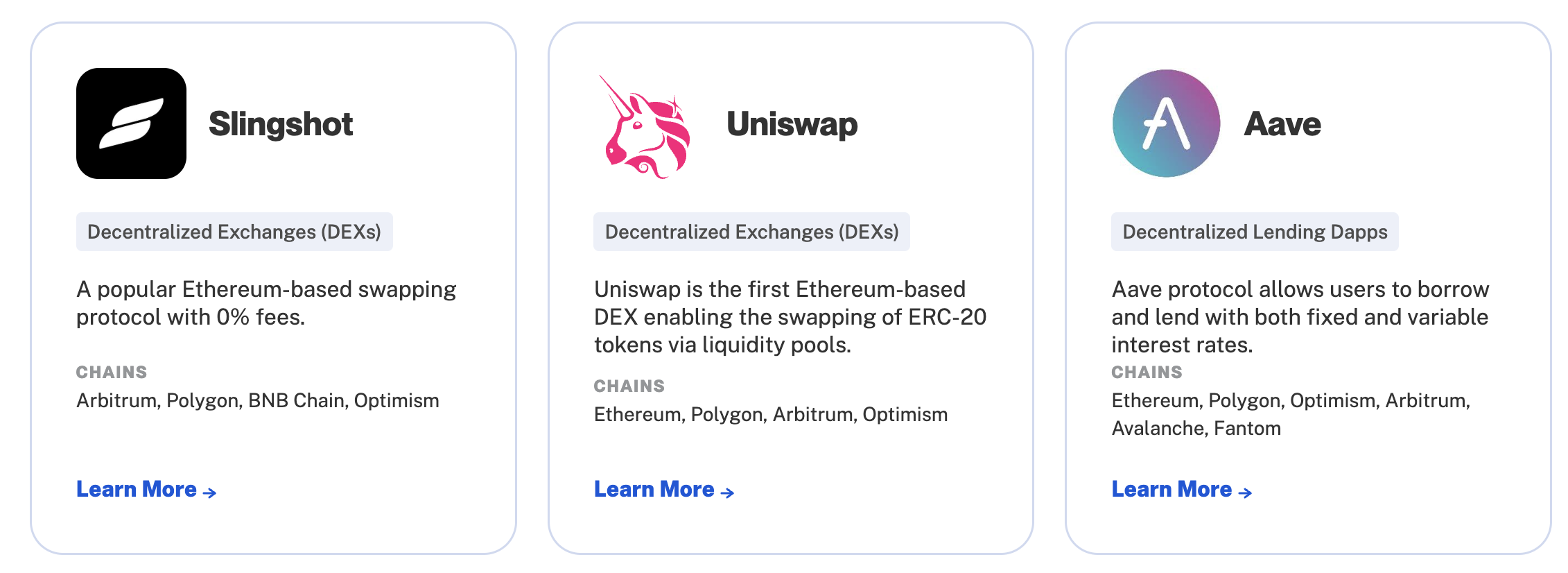

2.2 Arbitrum VS Optimism, Eco System

As of April 2023, the locked-in value on Arbitrum has reached $80 billion, while Optimism has $10 billion. Additionally, Arbitrum’s processing speed is 5 times faster than Optimism.

After its launch, Arbitrum gained support from 37 mainstream Dapps and a total of 354 Dapps including unknown ones. On the other hand, Optimism supports 34 Dapps.

2.3 Arbitrum VS Optimism, Roadmap

Arbitrum’s development roadmap in 2023 still focuses on technological advancements, in addition to supporting DEXs and DeFi applications, Arbitrum is also pursuing faster processing speed and throughput. On the other hand, Optimism is focusing on solving the vulnerability issues in single-round fraud-proof mechanisms, upgrading the fraud-proof algorithm to achieve higher security.

3. Real-time price comparison of Arbitrum vs Optimism on BingX exchange, which coin is more suitable for investment?

As mentioned earlier, the lock-up amount of ARB is huge, which means that if these tokens are unlocked, the selling pressure will be very large. Fortunately, ARB’s unlock is linear, which means that there will be no unlocking in the first year of token issuance. However, in fact, the Arbitrum token ARB was unlocked on March 23 at 20:30:00, with 5,553,000,000 tokens, accounting for 55.53% of the total supply. Currently, over 320,000 ARB tokens have been transferred to the treasury address. The unlocking of ARB tokens has caused a huge community controversy and subsequently dragged the price of ARB tokens down to around $1.

ARB price BingX

OP Price, BingX

Affected by the recent Bitcoin price, the price of ARB token soared to $1.64, and the price of OP token soared to $2.73. The historical highest price of OP is $3.24. The total supply of ARB token is 10 billion, and the total supply of OP token is 4 billion. As mentioned earlier, both currently have similar mainstream DApp support, with no apparent differences. However, ARB has a huge amount of lock-up tokens. This does not mean that the price of ARB will rise with the increase of lock-up tokens, but rather it means that in a market with a lack of funds, the selling pressure of ARB will be larger than that of OP.

Therefore, in the short term, the current price of ARB is a high point. Unless there are makers coming in to push up the price, the short-term outlook for ARB is still bearish, and the current price of $1.64 is not considered a good entry point. The long-term fundamentals and technology of ARB are better than those of OP. The current price of OP appears to be overvalued. Therefore, in the long run, the price of ARB will certainly surpass that of OP.

External factors, such as the impact of Bitcoin, have a significant influence on the entire cryptocurrency market. When Bitcoin rises, altcoins will rise, and when Bitcoin falls, altcoins will fall. It is still not a bull market at present, so users should be more cautious when investing in cryptocurrency, especially altcoins. It is recommended to use small amounts for investment and adopt contract trading, and set stop loss and take profit orders.

This article does not constitute any investment advice, and cryptocurrency investment carries risks. Here, we only help users simplify and accelerate their DYOR process. Users can choose to follow QA.BingX.com to get the latest value analysis reports.