What’s BTCUSDT Bitcoin Price Prediction May 2023

April 25, 2023

Is Swingby Token a Good Investment?

April 26, 2023Bitcoin’s 4th Halving Countdown, What is the Price Estimate?

Bitcoin Halving Countdown

days

hours

minutes

seconds

The important role of Bitcoin halving

Bitcoin halving refers to the halving of miner rewards. As the largest cryptocurrency by market capitalization, Bitcoin halving means a reduction in the amount of Bitcoin being issued, but it still remains in an inflationary state. The Bitcoin halving and inflation rates are as follows:

The first Bitcoin halving was in 2012, with miner rewards of 50BTC and an inflation rate of 12%.

The second Bitcoin halving was in 2016, with miner rewards of 25BTC and an inflation rate of 4%-5%.

The third Bitcoin halving was in 2020, with miner rewards of 12.5BTC and an inflation rate of 1.77%.

The fourth Bitcoin halving will be in 2024, with miner rewards of 6.25BTC and an inflation rate of 0.3% – 0.4%.

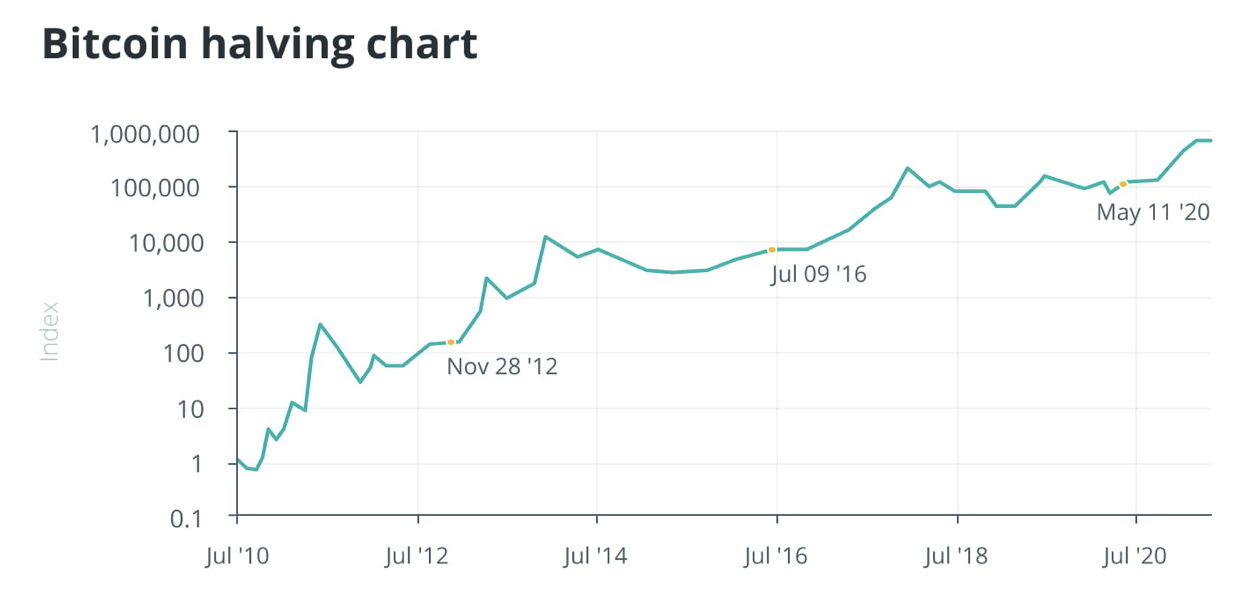

Bitcoin Halving History

By 2140, Bitcoin will no longer undergo halving and the inflation rate will be 0. The inflation status of Bitcoin has always been considered an important factor in measuring its value. It is also one of the strategies used by Ethereum to benchmark the value of Bitcoin. After the Ethereum upgrade, it is in a deflationary state. Therefore, it is generally believed that the long-term price of Ethereum should exceed that of Bitcoin.

Cryptocurrency inflation is a trap in asset value research

The supply and demand relationship determines the price of cryptocurrency assets. When the supply decreases and demand increases, the price rises. Bitcoin’s high degree of decentralization and transparent mechanism make it more trustworthy than traditional stocks, which can issue new shares at will. Although stocks cannot be used as currency, Bitcoin is starting to be directly used as a medium of exchange in many countries.

Ethereum has become the core technology of blockchain because of its smart contracts. Using Ethereum is necessary for technologies based on the Ethereum framework. This has led to many new blockchains benchmarking against Ethereum, such as SOL, OP, SUI, and ANT. These technologies will only become more perfect and secure based on Ethereum. The deflationary state of Ethereum may also lead new projects to use new public chains instead of Ethereum.

The market expresses demand through fiat currencies. The market has fiat currencies that provide liquidity for assets, known as hot money. More hot money indicates strong demand, while less hot money indicates decreased demand.

Therefore, determining the price of cryptocurrency cannot rely on inflation or deflation as the main factor. Instead, it is important to consider how much hot money will provide liquidity for a cryptocurrency. The SEC once required regulation of Ethereum, causing its price to fall because once regulated, hot money would withdraw from the Ethereum network. Therefore, Ethereum’s biggest problem is its high level of centralization. During the Silicon Valley Bank crisis, many users bought Bitcoin instead of Ethereum, which proved that the market has a clear preference for cryptocurrencies.

What will be the price of Bitcoin after the third halving?

Bitcoin halving refers to a reduction in miner rewards and not a halving of the supply. After the halving, the supply of Bitcoin still remains in an inflationary state. Therefore, the market where Bitcoin exists and the flow of hot money determine the price. Bitcoin itself does not have any inherent value, just like any fiat currency. No currency has inherent value. Value is generated due to the supply-demand relationship that leads to currency liquidity.

After the first Bitcoin halving in November 2012, the bitcoin price soared ten times from $12.5 to $127. The US M2 money supply was $765.3 billion, while China has no data on M2 money supply, only stock data, which is not included in the analysis.

After the second Bitcoin halving on July 9, 2016, the bitcoin price increased from $650 to $758. The US M2 money supply was $13,273 billion, and the Federal Reserve increased interest rates in 2012, withdrawing a large amount of hot money from the market. China began banning Bitcoin in 2013, so the price of Bitcoin did not rise significantly after the halving. In comparison, the US M2 money supply increased 17 times from 2012 to 2016. This did not prevent hot money from flowing into Bitcoin, pushing the price to $20,000.

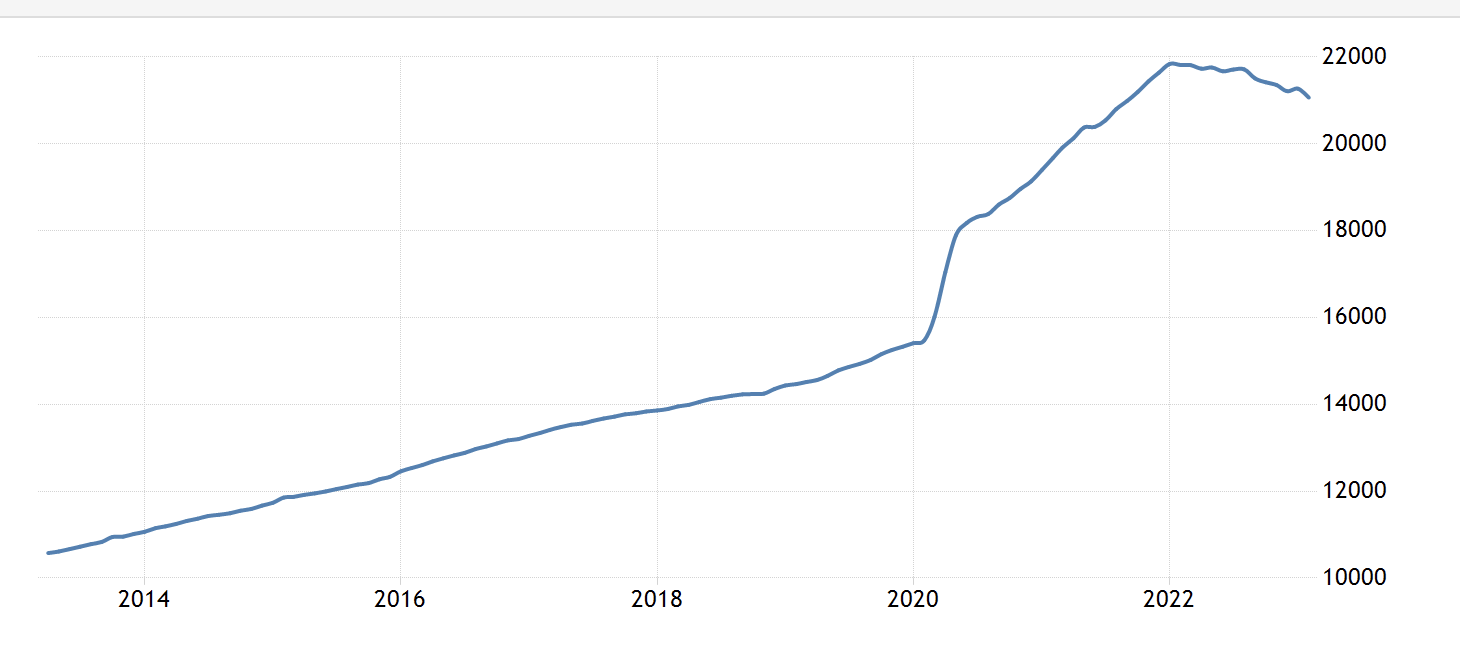

After the third Bitcoin halving on May 11, 2020, the bitcoin price rose from $8,821 to $10,943. The US M2 money supply was $15,207 billion, and it reached a new historical high of $21,267 billion after the halving. A large influx of hot money caused the price of Bitcoin to soar to a high of $60,000.

It is clear that there is a direct correlation between the price of Bitcoin and the M2 money supply. The flow of hot money in the market is what drives the price of Bitcoin up.

(United States Money Supply M2, 2023)

The fourth halving of Bitcoin will occur on May 4, 2024. Based on the market’s hot money indicator M2 money supply, there will not be a significant increase in the price of Bitcoin after the halving. There is no basis for the market’s expectation that the price of Bitcoin will reach $50,000 after the halving. Bitcoin is currently priced at $27,000, and unless the US M2 money supply increases in 2024, the price of Bitcoin will not exceed $40,000.

US M2 money supply forecast

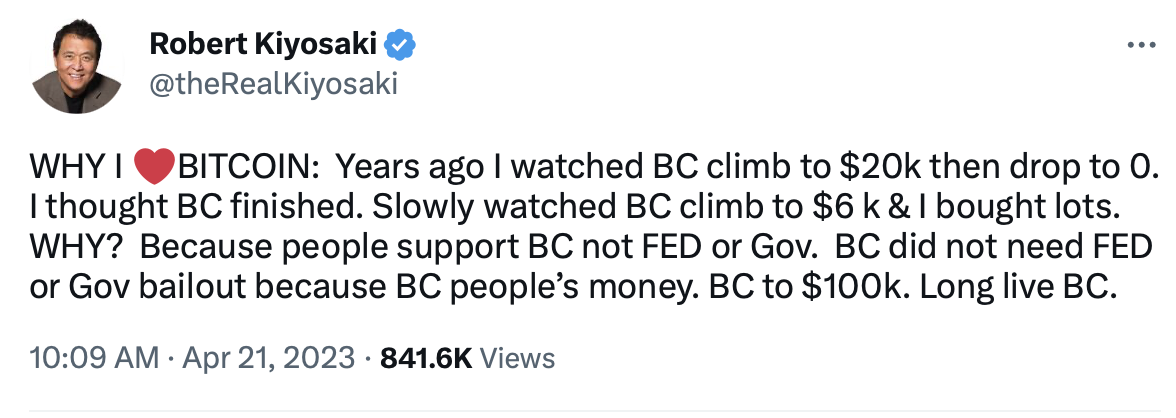

It is difficult to predict the US M2 money supply in 2024, given the current situation of interest rate hikes. However, it is important to note that the BTFP policy allows the US Treasury to print unlimited amounts of money. If the US announces an economic recession in 2023, it is likely that the printing press will be opened again in 2024, releasing a large amount of hot money into the market. It is estimated that this release of hot money will be even greater than the last time. Rich Dad Poor Dad author Robert Kiyosaki predicts that the price of Bitcoin will soar to a historic $500,000 in 2025, and soon will be $100,000 based on this(Kiyosaki, 2023).

(Kiyosaki, 2023)

In addition, there is a high probability that Bitcoin will continue to decline to a price of $26,500 in the short term. Due to the uncertainty of future Bitcoin prices, investors need to make careful decisions.

Reference

United States Money Supply M2. (2023, 3). Retrieved from Trading Economics: https://tradingeconomics.com/united-states/money-supply-m2

Kiyosaki, R. (2023, 2 13). Robert Kiyosaki. Retrieved from Twitter: https://twitter.com/theRealKiyosaki/status/1624988584267894784

BingX (2023,3,29) Retrieved from BingX QA:

https://qa.bingx.com/what-is-btfp-why-is-it-referred-to-as-the-direct-reason-for-bitcoins-rise-from-19k-to-27k/

Bitcoin Price, Retrieved from BingX Price:

https://qa.bingx.com/bitcoin-btc-usdt-price-news-trading/