How does the stock market affect Crypto markets?

March 21, 2023

What is Market Cap and how it helps us understand about the Crypto we are investing?

March 22, 2023What’s Arbitrum Airdrop and Price Prediction

What is Arbitrum? Why is there so much attention on its airdrop?

Arbitrum is a layer 2 solution for Ethereum, primarily addressing speed and scalability issues while also adding additional privacy features. Arbitrum uses transaction batching to submit data to Ethereum in batches and then executes them on the second layer. This allows Dapps built on Ethereum to operate faster, more efficiently, and with lower gas fees.

Arbitrum is developed by Offchain Labs, with core members Ed Felten and Steven Goldfeder. It primarily competes with another Layer2 solution, Optimism (OP). The recent attention on its airdrop is likely due to the potential benefits and advantages it offers to the Ethereum ecosystem.

BingX Market Cap

The current price of OP is $2.61, so it is believed that the price of Arbitrum, which competes with OP, will rise to the high level of $2.61. Currently, the Arbitrum airdrop requires almost no cost, and users only need to complete certain tasks to receive a certain amount of airdropped tokens. Some users have received up to 50,000 ARB airdrop tokens. Therefore, after the token is listed on exchanges, the price of ARB may reach $1.3, which means users can receive tokens worth up to $65,000. This is why many users are participating in the ARB airdrop event. ARB is the token of Arbitrum, and it can be traded on the BingX exchange under the symbol ARB/USDT.

ARB price prediction

As for ARB price predictions, it is difficult to accurately predict the future price of any cryptocurrency as it is subject to various factors such as market trends, adoption rates, and regulatory developments. It is important for investors to conduct their own research and analysis before making any investment decisions.

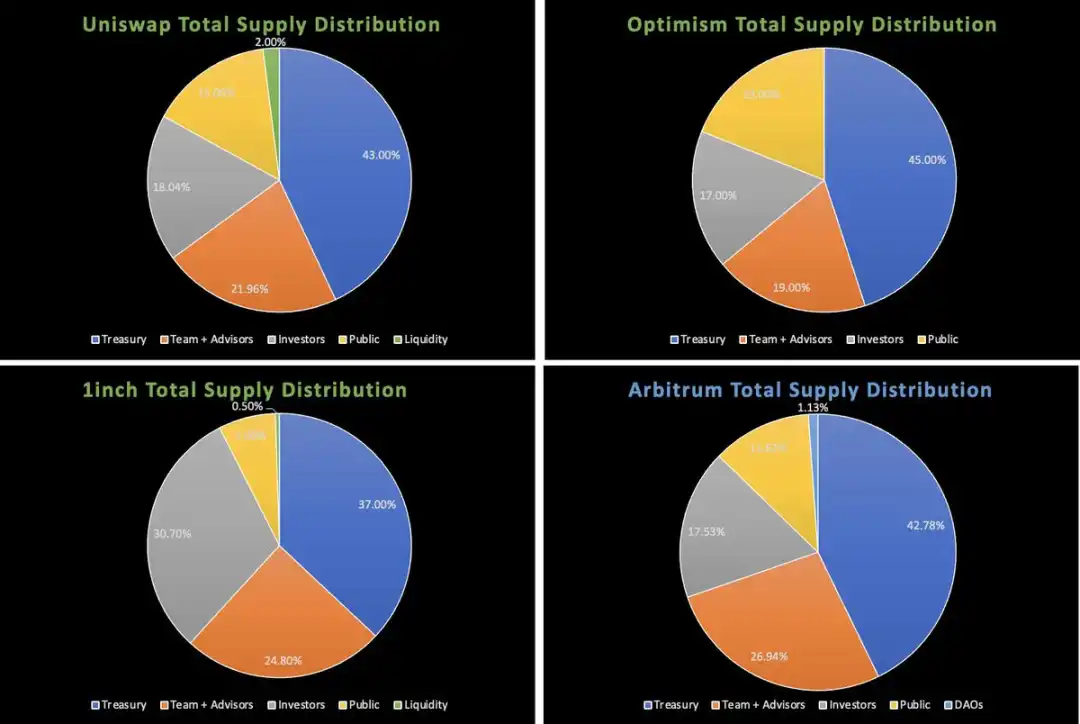

ARB currently occupies a market share of 55% in the Layer2 market, making it the leader in Layer2 solutions. Its overall allocation ratio is similar to OP, Uni, and 1inch. 11.62% of the initial supply was airdropped to regular users, and a total of 625,143 addresses met the requirements to receive the airdrop, with an average of 1,895 ARB per account. The biggest difference between ARB and OP is that OP only airdropped a third of its overall supply. Due to the current market conditions, Bitcoin is attracting a lot of capital as a hedge. Therefore, it is unlikely that regular users will buy and hold ARB for the long term under this hedging sentiment.

After ARB is listed on exchanges, its short-term price is expected to reach a high of $2.6, which may trigger selling pressure and cause the price to fall below $1 in the short term. Users who sell ARB will likely use the proceeds to buy BTC.