How to Market a New Crypto Project

March 28, 2023

What’s TrendSpider?

March 30, 2023Besides Arbitrum Airdrops, What Other Ways To Make Money?

1. The first way to make money through Arbitrum: Airdrops

Making money through Arbitrum doesn’t just rely on airdrops, but also on the fact that the token ARB will be listed on various centralized exchanges. If ARB is airdropped but the token cannot be traded on major centralized exchanges, then the price of ARB will not reach its highest potential. Most users only start paying attention to ARB airdrops once they learn that the token will be listed on centralized exchanges, so there are only around 625,000 effective addresses for ARB airdrops. On average, each address receives around 3,500 ARB, which means that at least one address can earn $3,500.

Regardless of whether the market is in a bear or bull trend, the key factor in determining the rise and fall of blockchain projects is the amount of hot money entering the market. Long-term hot money refers to investments, while short-term hot money refers to speculation. In an overall market downturn, there is not enough hot money, so the price of ARB during the bear market did not stabilize at the estimated 2U price, but fluctuated around 1.2U. From a trend analysis perspective, if ARB falls below 1U, it may drop to the originally estimated price of around 0.6U, which can be considered an ideal entry point for ARB.

2. The second way to make money with Arbitrum: Right Time

In the analysis of the “100x coins”, it was pointed out that Arbitrum is the Ethereum Layer 2 solution that supports over 100 projects, with a total of 8 projects locked worth over 100 million, including SushiSwap, GMX, Stargate, Curve, Dopex, Treasure DAO, Synapse and dForce. Therefore, its foundation is very strong. It can be expected that if the market enters a bull market and there is an influx of hot money, the price of the ARB token will definitely rise. As for how high it will go, in the analysis of Bitcoin prices, it is mentioned that the prices of altcoins are affected by the price of Bitcoin. If the price of Bitcoin goes up 5%, the price of altcoins will go up 25% or even more. If Bitcoin is expected to exceed $48,000 in a bull market, then the price of ARB will rise to around 20U. However, if you buy ARB at a high price in a bear market and get stuck with your funds, even if the price rises in a bull market, you will earn less money. For example, if you bought at 20U on the day of its release, you will be at a loss, and at best you will break even when the bull market arrives.

In terms of ARB price prediction, the estimated bottom price for ARB is $0.60, and some analysts believe that a reasonable price is $0.40.

The entry price is extremely crucial. Buying ARB at $0.40 may only be possible for a few seconds.

3. Third way of making money thtough Arbitrum: To Provide Liquidity

According to on-chain data reports, five whales purchased over 13 million ARB tokens at a price range of $1.28 to $1.38. An address starting with 0xb0fc7 bought 2.74 million ARB tokens using 3.52 million USDC at a price of $1.28. This address has earned $1.77 million in trading fees by providing liquidity for ARB on Uniswap. Therefore, the actual purchase price of ARB for this whale was $0.45.

It is important to pay attention to when this ARB will enter centralized exchanges. In a bear market, the turnover of funds is faster, and at some point, the whales may sell their ARB before waiting for a bull market. There is a risk of holding altcoins until a bull market as they may not survive a bear market and go to zero.

How To Earn Trading Fees Through Provide Liquidity?

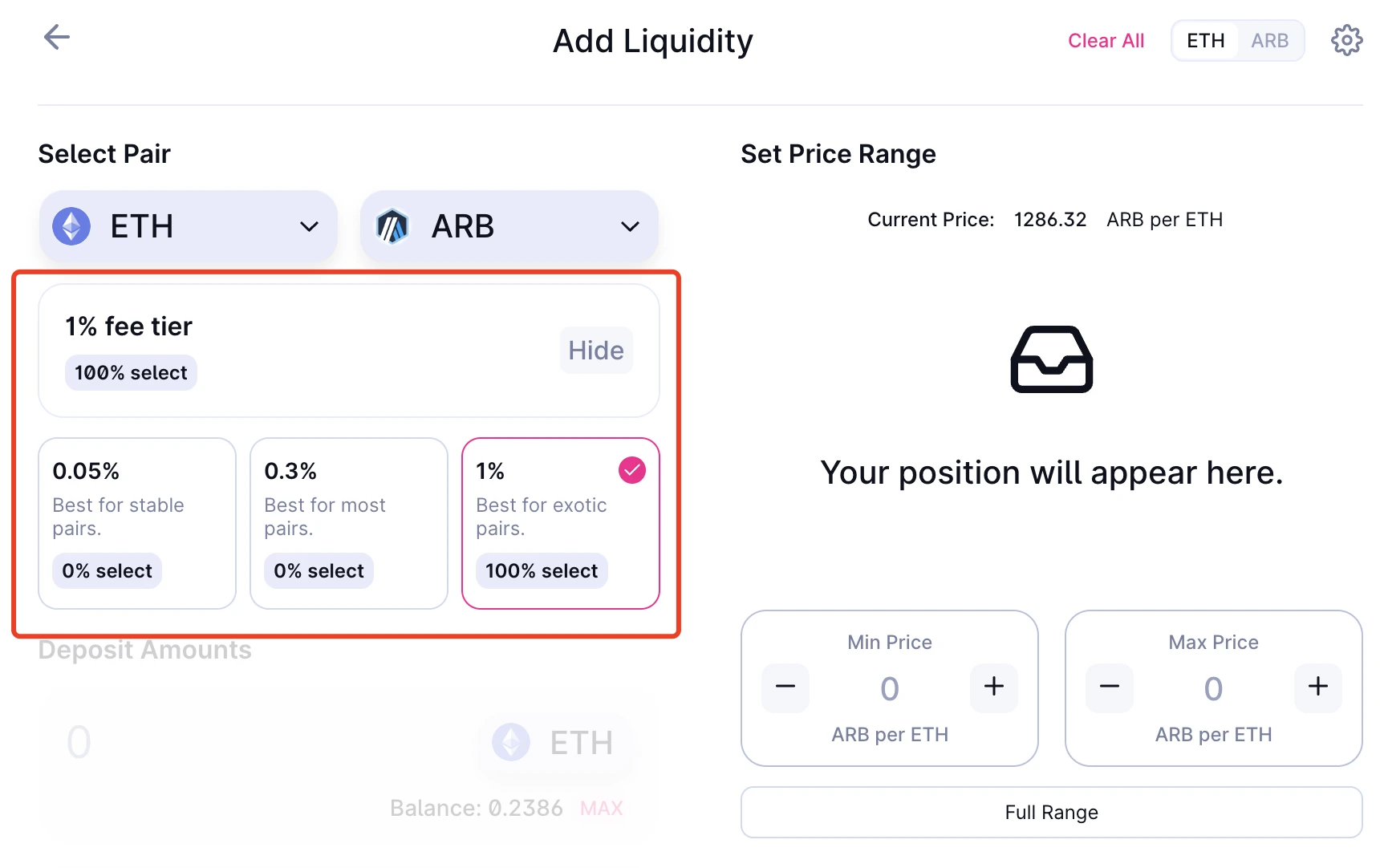

First, it’s important to understand that decentralized exchange trading pairs are not determined by the exchange but rather by the liquidity providers or market makers. For example, a market maker creates an ARB liquidity pool on a decentralized exchange and has a large amount of ARB and accepts USDT. Therefore, the market maker provides an ARB USDT trading pair, and users holding USDT can exchange it for ARB in the liquidity pool, or vice versa. To encourage market makers, decentralized exchanges allow liquidity providers, who are also market makers, to set transaction fees, up to a maximum of 1%. Since any user with sufficient funds can create a liquidity pool, transaction fees decrease as liquidity increases. In theory, they can approach zero, but Uniswap sets the minimum at 0.05%. If transaction fees fall below this level, market makers tend to close their liquidity pools and withdraw their funds.

3.1 How to Create a Liquidity Pool

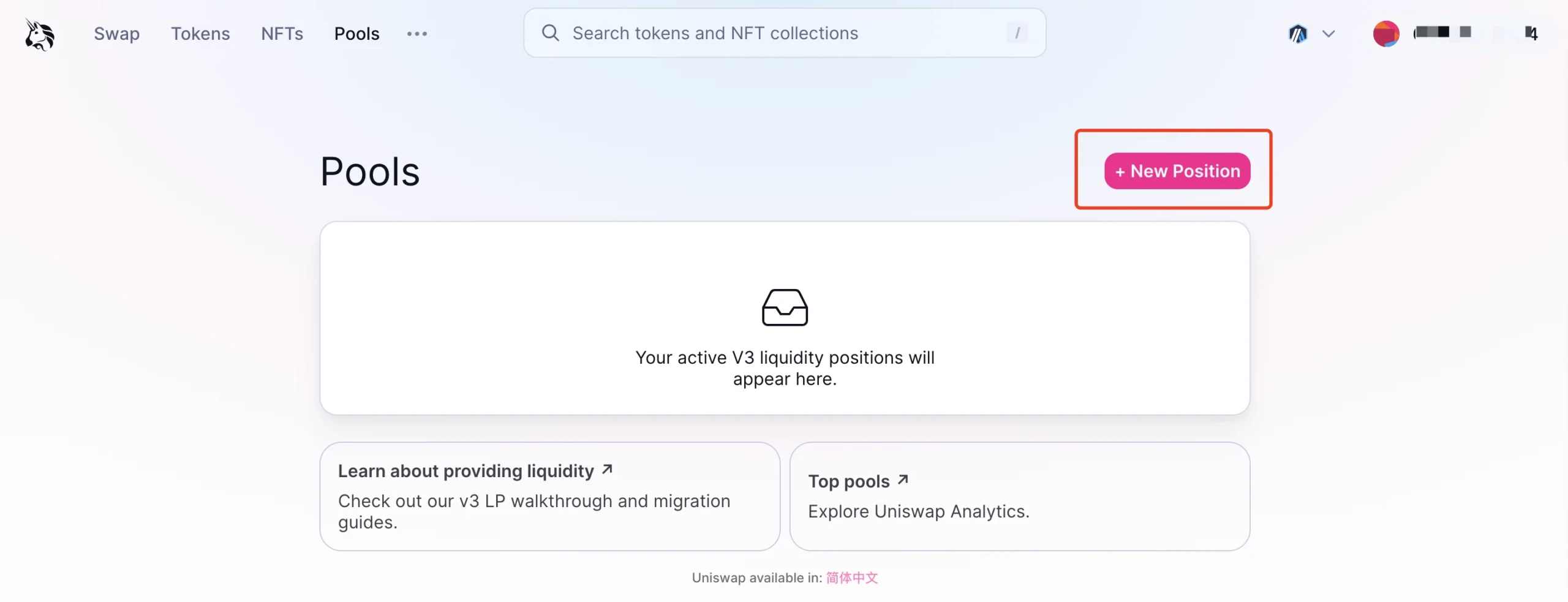

Step 1: Ensure that you have enough coins in your wallet and that they have high liquidity. Log in to Uniswap and select “New Position”.

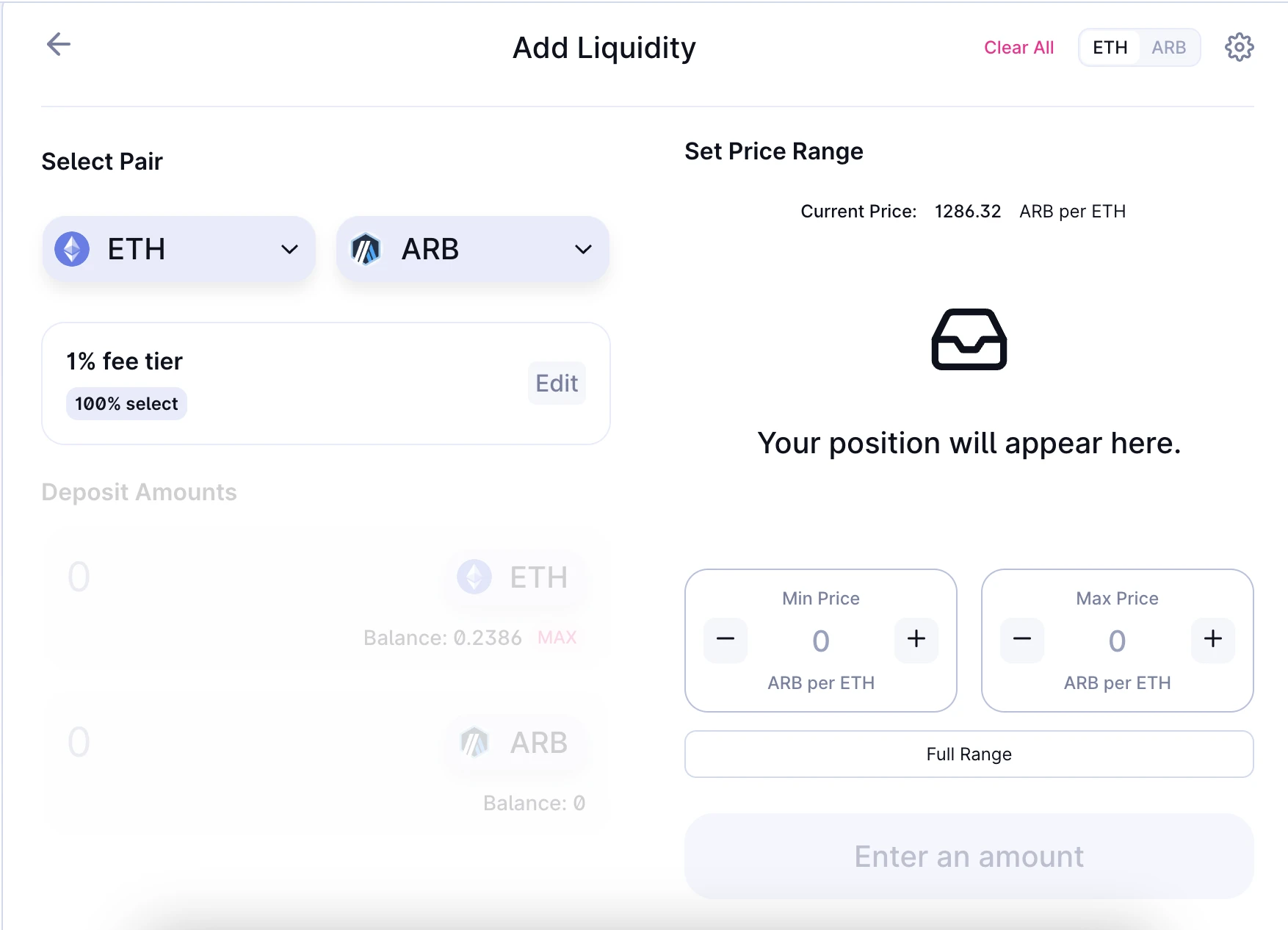

Step 2: Create a trading pair and add liquidity

Step 3: Set Transaction Fees

Risk of decentralized exchanges and liquidity pools: There is a certain risk associated with liquidity pools, with the main risk being liquidity. Popular currency pairs have good liquidity, so there are correspondingly more LPs. Less popular currency pairs have no liquidity, so there are no traders. At the same time, the price comparison itself will fluctuate. Decentralized exchanges do not use matching on currency prices, but algorithms instead. This will also allow for arbitrage to occur on decentralized exchanges. Once a user discovers an arbitrage opportunity, it is often the market maker who suffers losses. Therefore, this is also a game of wealth.

Summary:

When it comes to making money with altcoins, risk and return are proportional. Therefore, capital management is the most important thing, and “all in” is the biggest problem in altcoin investments because losing once means there is no extra capital to take the next adventure. For users who have never encountered liquidity pools, it is not recommended to use liquidity pools to make money because the predictable result is that they will lose money the first time. In addition, liquidity pools require a large amount of capital, and losing everything in one go is a possibility. Apart from missing out on better opportunities in the future, it can also affect daily life due to the loss of funds. Finally, it should be noted that decentralized exchanges are not supported in many countries and regions due to high risks and lack of regulation. If you are a beginner, the best way is to start with airdrops and exchange time for capital. Other than the cost of time, there are no additional losses.