How To Buy Sell BRC-20 SATS Coin

September 22, 2023

Big Time (BIGTIME) Coin price and prediction

October 12, 2023Research: What Tokens Will have Prices Increasing 10 times in Q4 2023?

Table of Contents

In the analysis of Bitcoin prices on BingX, it is noted that Bitcoin’s price is influenced by the Federal Reserve’s interest rate hikes when market liquidity is poor. Given that the overall market capitalization of Bitcoin has reached $550 billion, which is higher than the second-ranked Ethereum at $220 billion, it is unlikely that the price will more than double in the fourth quarter of 2023. The estimated likelihood of the highest price being at $28,300 is 80%, $29,761 at 60%, and $31,000 at 33%, with the lowest price at $26,000.

Furthermore, because the likelihood of the Federal Reserve raising interest rates in the fourth quarter is not more than 33.8%, there is a 66.2% chance that interest rates will remain unchanged in Q4. Therefore, the market still lacks liquidity. In a cash-strapped market, small increases in Bitcoin prices can lead to significant increases in potential altcoins. In a cash-strapped market, a 100x increase also means 100x risk and is unlikely to be sustained. However, tokens that may increase 10x in Q4 2023 will see even more growth in the 2024 bull market.

So, how to identify tokens that could increase by more than 10x in Q4 2023 will determine how much users can earn in 2024.

1 How to Discover Tokens with More than 10x Growth?

In addition to identifying tokens that will increase by 10x, the main focus of the report is to share strategies. It’s important to note that investing in cryptocurrencies carries risks, and any report may have imperfections and blind spots. The report’s intention is primarily to educate readers and help them form their own investment strategies.

Once again, it’s essential to emphasize that investing in cryptocurrencies is risky. This content does not constitute any investment advice, and users must conduct their research (DYOR – Do Your Own Research).

1.1 First Point: Market Capitalization

Tokens that are likely to increase by more than 10x will have market capitalizations of less than 1/100th of Bitcoin’s market capitalization. Smaller market-cap tokens require only a small portion of liquidity to drive up prices. Since Bitcoin’s market cap is $550 billion, tokens with market caps below $5 billion have a higher chance of increasing 10x.

1.2 Second Point: Hot Projects

Market makers drive up token prices by providing liquidity. However, according to the economic principles of supply and demand, price increases resulting from one-sided purchases are limited. This requires tokens to have intrinsic market demand. A clear example is Solana’s token, which saw a 100x increase between July and November 2021. In addition to liquidity provision, one of the primary reasons was the hot project StepN at the time, which increased the demand for SOL. After StepN faced various issues and its popularity decreased, SOL’s token price experienced a significant drop. These kinds of tokens are not the main focus of this report as they carry high speculation risk. Moreover, due to SOL’s large market capitalization, it’s highly unlikely to increase by more than 10x in Q4 2023.

The overall market trend in 2023 appears to be increasingly rational, with a preference for tokens with utility and value. Additionally, regulatory pressures are growing. BingX predicts that 2024 and 2025 will be the years of the strictest regulations.

Strict regulations have made DeFi a hotspot. Therefore, after Q4 2023, the hot projects are expected to be in DeFi and tokens with high utility value. Contrary to many other viewpoints, this report does not consider Metaverse and GameFi as the hot investment sectors after Q4 2023. Metaverse and GameFi tokens tend to perform well when there’s excess money in the market, which means users have more time for entertainment. In the context of the overall U.S. economy, the chairman of the Federal Reserve has explained that the cost of the U.S. labor market remains high, implying that consumers will not experience a significant increase in income during the bull markets of 2024 and 2025. Therefore, there won’t be more money available for entertainment.

So, the hot sectors are DeFi, public chains, and tokens with high utility.

1.3 Third Point: Assessment of Utility

Utility is mainly evaluated using three dimensions to comprehensively assess a project’s utility and reduce uncertainties when investing. These three dimensions are “cheaper,” “better,” and “faster.” These dimensions align with the theory of the late former Prime Minister of Singapore, Lee Kuan Yew.

– “Cheaper”: Projects that can reduce costs inherently have an advantage. For example, Ethereum’s London upgrade reduced costs for Layer 2 solutions, leading to price increases for tokens like ARB, OP, ZKSync, BASE, and Linea. This upgrade also benefits tokens solving cost issues in traditional industries. Blockchain projects cannot afford to be disconnected from traditional industries, which are fundamental to high-tech industries. Just as the speed of a wheat harvester can increase, wheat still needs to grow. Therefore, the London upgrade benefits Layer 2 tokens, but if a Layer 2 ecosystem is too far removed from traditional projects, the Layer 2 token may not leverage the advantages brought by the upgrade.

– “Better”: Projects with high implementation feasibility and rapid iteration are favored. Constantly striving for better products that meet user needs is essential. Projects with slow upgrade cycles may indicate problems and lack investment potential.

1.4 Fourth Point: Investment Background and Social Media Data

Unlike typical market analysis reports, this report does not consider investment background and social media data as the main analysis indicators but rather as secondary indicators. The reason is that fundraising in the blockchain industry is relatively easy. Even in the worst case, projects can obtain funding through CEX launchpads and Uniswap. However, by the time projects with well-known financial backgrounds are listed on centralized exchanges (CEX), investors have already made at least 10x profits, making projects that could still grow 10x very rare.

Retail investors usually depend on airdrops to make profits. If the project team does not distribute airdrops, or if they only distribute valueless NFTs, retail investors may not only fail to profit from airdrops but may also lose time and gas fees. Such risks can be higher than the risks associated with trading tokens themselves.

Social media platforms can quickly gain a large following and fan base through collaborations with Key Opinion Leaders (KOLs). This can overshadow the project’s own issues and lead to Fear of Missing Out (FOMO). Therefore, these two sets of data are used as references. However, if a project does not align with the first, second, and third points mentioned earlier, it may not have practical investment value.

2. Token Risks and Trading Strategies

Investing in cryptocurrencies involves risks. A 10x increase in price also implies a 10x increase in risk. When trading tokens using BingX spot trading, it’s recommended to set stop-loss limit orders after purchasing tokens. The report will provide a stop-loss price. This means that once a certain loss threshold is reached, the system will automatically trigger a sell-off to prevent further losses.

Once tokens have appreciated in value, you can modify the selling price using a Trailing Stop approach for spot investments.

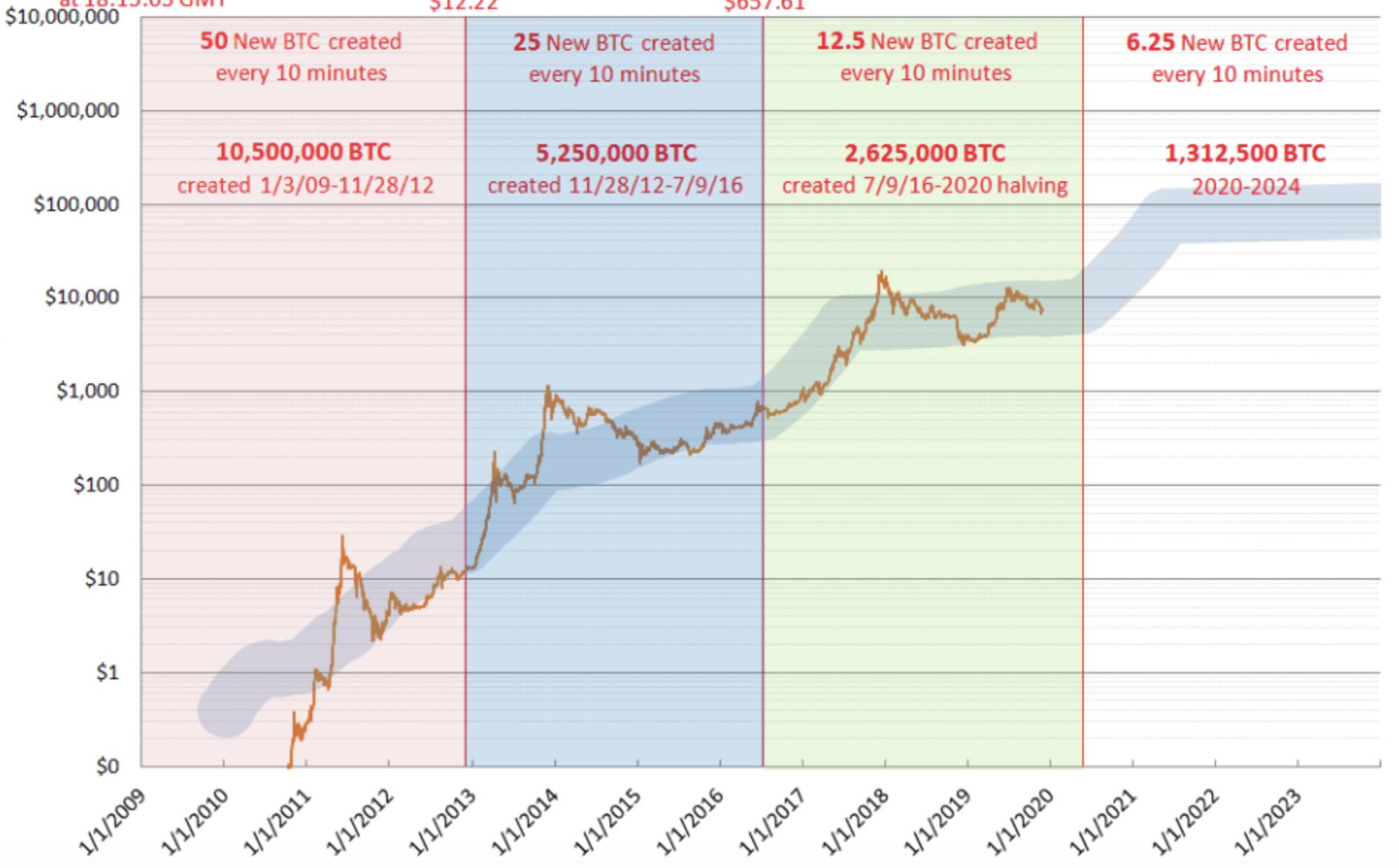

It’s crucial not to have emotional attachment or unwavering “belief” in any token. As highlighted in the BingX Bitcoin price analysis, 2024 and 2025 could potentially be the final bull markets for Bitcoin with a chance of over 100% price increases. Beyond that, while Bitcoin may continue to grow, its price increases may not exceed 50%, and there could be a drop exceeding 75% in the next bear market. Only CEX can allow users to continually adjust Limit Orders to maximize their assets at their peak.

If you are using BingX perpetual contract trading, it is advisable to use X2 leverage and keep raising the stop-loss price to mitigate losses due to market changes.

To download the complete token report, please click [**here**]

Please note that cryptocurrency investments carry inherent risks, and it’s crucial to perform thorough research and due diligence before making any investment decisions. This report does not constitute investment advice, and users should exercise caution and make informed choices.

Update for October 25, 2023

The analysis for this report was completed on October 1, 2023, and it was published on October 2nd. Since then, there have been changes and adjustments in asset prices and portfolios. The adjustments and content are as follows:

$ARB: The token faced downward pressure due to a second-round airdrop. The Ethereum London upgrade did not address the relatively high centralization in Ethereum tokens. As a result, the ARB token price declined, falling all the way to $0.769, although the stop-loss was not triggered. After a comprehensive evaluation, it was decided to reallocate the funds into tokens with better price performance.

$ANT: The token triggered a stop-loss at $4.85.

$AAVE: The stop-loss level has been raised to $75.16.

$STORJ: At the time of publication, the token’s price showed signs of retracement. Users who entered during the retracement are currently in profit, while those who entered on the publication date are in a loss. The token has not yet entered an upward channel, and the recent rebound was influenced by the rise in BTC prices. Price is expected to experience some period of volatility, but the token’s holdings have been consistently increasing.

The stop-loss price remains unchanged.

$RDNT: The token’s price is currently at the bottom and has experienced a slight rebound, influenced by Bitcoin.

Note:

This is a medium-term trading strategy with a holding period of 144 days. Due to the risk factors involved in trading, this report does not specify entry prices and points for tokens. Only stop-loss prices are provided, and users must decide on their entry timing independently.