How To Do Coinbase Token Base Free NFT & Airdrop?

May 29, 2023

What’s Lybra Finance $LBR Coin? Price? Where To Buy?

May 30, 2023What’s LSD Liquid Staking Derivatives? Recommended Coins

Table of Contents

What’s Liquid Staking Derivatives?

LSD stands for Liquid Staking Derivatives. Its main purpose is to enable the trading of staked tokens as derivatives in the DeFi space. Typically, derivative trading takes place on centralized exchanges (CEX) and is linked to spot prices. To ensure price stability and prevent deviation from spot prices, CEX derivative prices often use the average spot prices from multiple exchanges (Harvey, 2021).

In traditional setups, staking and derivative trading are separate activities, and users cannot simultaneously use their funds for both purposes. Additionally, after the Ethereum network upgrade, nodes require a significant amount of staked ETH to validate transactions on the Ethereum network. This staking requirement involves a substantial amount of capital. If this capital could be converted into derivatives for trading, it would inject a significant amount of hot money into the market (Harvey, 2021).

LSD Aims to Address Liquidity Issues in DeFi

LSD does not directly solve the liquidity problem for staked tokens but helps DEXs and DeFi platforms offer derivative trading by transforming staked tokens into derivatives. This provides higher liquidity options for the DeFi ecosystem (Scharnowski, 2023).

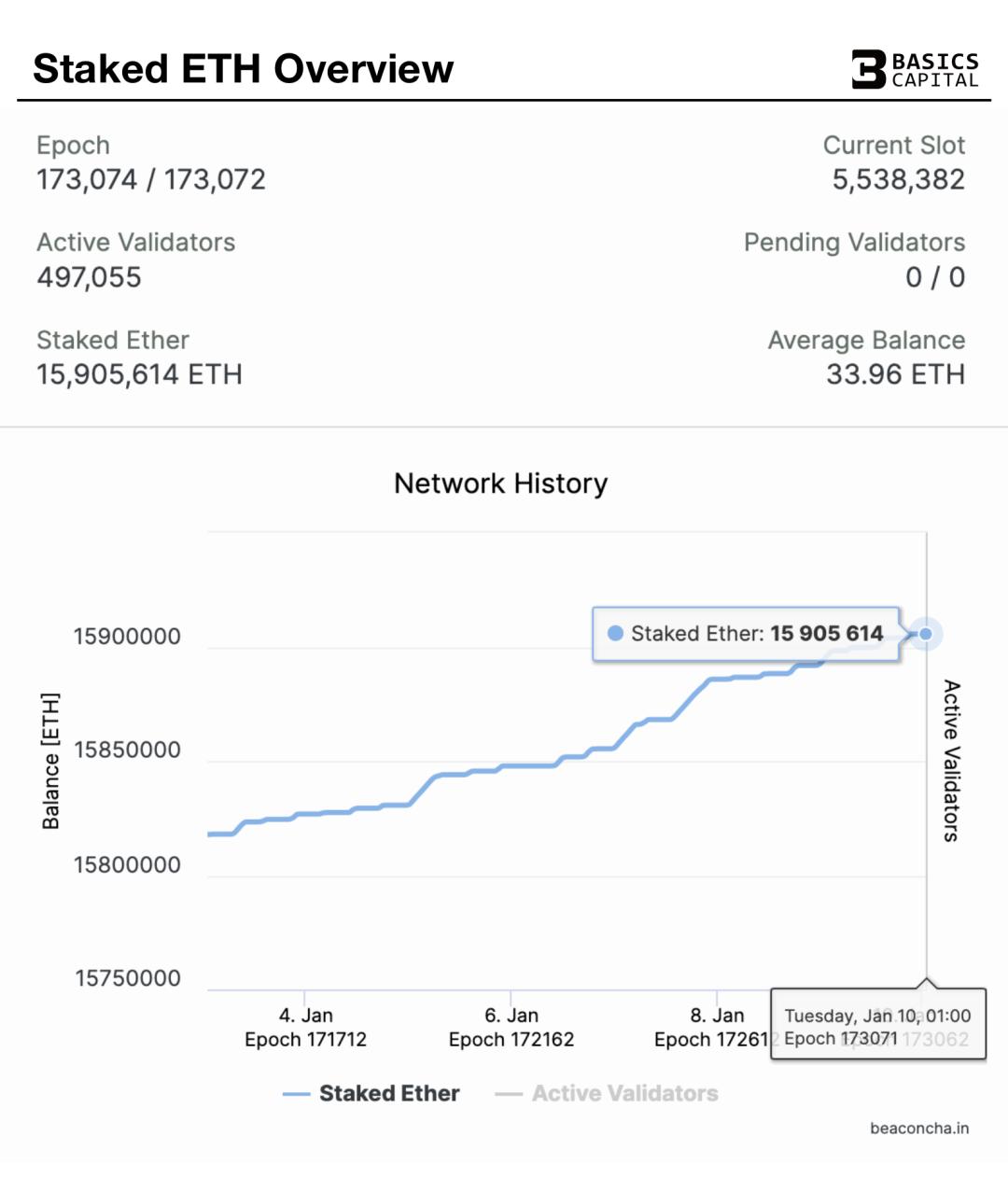

Recent data indicates that the total amount of staked tokens, specifically for Ethereum, is around 15 million, equivalent to nearly $60 billion. By leveraging the LSD protocol to unlock this capital, it can have a significant positive impact on the cryptocurrency market, particularly during bearish market conditions (Heimbach, 2023).

What is the Operating Mechanism of LSD?

LSD, which stands for Liquid Staking Derivatives, allows users to transform their staked tokens into derivatives for trading. When tokens are staked, there is a certain level of risk involved as the token price may decline while the tokens remain locked in the staking pool. Similar to traditional banks, users borrow tokens but do not return them immediately. Through the LSD protocol, users can generate derivative tokens that are used within the DeFi platform. These derivative tokens can be used to trade other assets, such as purchasing spot tokens.

For example, if a user stakes $200 worth of ETH and obtains $200 worth of derivative tokens called lsETH (used as an example, not a real token) through the LSD protocol, they can use lsETH to purchase $200 worth of other tokens on the platform. The initially staked ETH continues to earn profits.

After the staking period ends, users receive staking rewards, and the spot tokens equivalent to the $200 worth of lsETH they purchased are still held.

What are the risks of LSD?

While the LSD protocol provides liquidity to DeFi and DEX platforms, it also carries significant risks. The main risk lies in the potential “bubble” formation of tokens, which could lead to default and the collapse of the DeFi market. Similar to traditional banks, but with decentralization, DeFi faces higher risks than traditional banks.

LSD makes DeFi almost like traditional banking but without central bank control or regulation. Therefore, LSD may trigger increased regulation and undoubtedly expose the DeFi market to black swan events. Any new field experiencing rapid growth inevitably generates bubbles.

What are some notable projects related to LSD?

- Lido

Lido occupies 88.41% of the ETH staking market share, making it the biggest beneficiary of LSD. The price of Lido tokens has also seen an increase due to LSD.

- Frax

With the help of LSD, the trading volume of Frax has rapidly increased, currently ranking among the top five LSD projects. Frax’s significant growth is also attributed to its diversified DeFi products.

- Rocket Pool

Rocket Pool started developing LSD solutions in 2021. After the Ethereum upgrade, Rocket Pool quickly became the second-largest LSD project in terms of market capitalization.

- Lybra Finance

Lybra Finance launched its token LBR in April 2023, and its token price skyrocketed by nearly 15 times in May. Research related to Lybra Finance tokens includes price predictions for LBR.

Summary:

LSD, by unlocking staked tokens indirectly, provides the market with nearly $100 billion in liquidity and is worth paying attention to. However, due to the bear market, LSD projects have experienced explosive growth and prematurely released a significant amount of hot money into Ethereum without strong project support, resulting in volatile price fluctuations for LSD-related DeFi tokens. LSD projects that survive this bear market are likely to make a more significant impact during the bull market.

Reference

Harvey, C. R. (2021). DeFi and the Future of Finance. WILEY.

Scharnowski, S. (2023). The economics of liquid staking derivatives: Basis determinants and price discovery. SSRN.

Heimbach, L. (2023). Defi lending during the merge. ARXIV.