100X Public Blockchain Tokens in 2024

November 13, 2023

100x Crypto Opportunities: Web 3 Games

November 28, 2023What Coins Can Be HOLD When Bitcoin Prices Fall (2023 Nov)

Bitcoin’s price on November 22, 2023, experienced a decline, falling from 36925 to 35275, a drop of 1000 points, but it did not break the support line.

The main reason for the decline is the $4 billion USD fine imposed by the United States on the Binance exchange, leading to the resignation of Binance CEO CZ. Binance occupies up to 60% of the trading volume in the spot market in the CEX, making it the undisputed leader, so the fine on Binance has caused panic among some users (Strohm, 2023).

As a result, the price of Bitcoin began to rebound at the price of 35275 and returned to the upward channel. In such a market situation, it is very suitable to hold some tokens for the long term, which have strong fundamentals and are undervalued.

Chart 1: BingX BTC price

When Bitcoin’s price rises, the prices of these tokens will soar higher.

The expected rise in the price of Bitcoin in 2024 will drive the development of three major markets:

- BTC Layer 2

- Applications

- AI

BTC Layer 2

After two previous bull markets, the landscape of smart contract public chains has taken shape, with Ethereum being the absolute leader in smart contract public chains. Although Bitcoin’s recent BRC-20 has been very popular, it has also exposed the core problem of Bitcoin: it is not suitable for complex transactions.

So BTC on-chain transactions have surged, and transferring funds from one wallet to another within a wallet takes a very long time (36 hours) if the SATS (miner’s fee) paid is not high enough. BTC Layer 2 will significantly reduce the time users spend on trading BTC. Compared to Ethereum Layer 2, because Bitcoin is more decentralized and has fewer community developers than Ethereum, the development of BTC Layer 2 is slow.

The development of BTC Layer 2 is also relatively early, taking only about 10 months from February 2023 to now. Projects are developed by the community and small teams themselves, and the technology is not very mature. With Ethereum’s narrative fatigue, BTC Layer 2 is a huge gold mine.

Applications

Public chains, as the foundation of blockchain, play a very important role. When developers choose which public chain to adopt, they determine the fate of the application in the future. So public chains, especially Ethereum-like public chains, need strong community support to attract developers (Chen, 2021).

Because the applications developed are ultimately for the community’s users. Ethereum, as the first-generation public chain with smart contracts, has the largest community. Challengers to Ethereum’s status will find it increasingly difficult unless Ethereum itself makes a fatal mistake.

So this bull market will not have as many potentially promising public chain projects as the last one. Even if there is a short-term rise, without corresponding application support in the later stage, there will be no long-term advantage. Therefore, in this round of the bull market, the focus will be on applications, and the most obvious example is AI.

AI Artificial Intelligence

To be precise, the bull market in the blockchain in 2024 is driven by AI, not ETF. Because AI has a huge demand for decentralized computing power, storage, and data. At the same time, many companies have found that AI can reduce some of their costs in using ChatGPT, such as programming, data collection, and online marketing. So AI will be a top-level development symbol in the blockchain application layer ( What are the potential AI tokens in November 2023?).

At the same time, readers should note that a Telegram Bot is not AI.

Potential projects for applications and AI

1. Chainlink $Link

In the Oracle project, Chainlink is recommended. The most important reason why $Link token is worth holding in the long term is Chainlink’s leading position in the Oracle market. And such a position is difficult to shake, despite many competitors. The main reason is that Chainlink has been working hard in the entire blockchain and traditional fields. Major companies including JP Morgan and Google have cooperated with Chainlink. So Chainlink has an absolute advantage in data. Similarly, data acquisition, no new language machine can obtain such a large amount of data in a short time. The core value of Oracle is off-chain data.

Chainlink is more centralized, and its speed is 100 times slower than the latest PYTH, but Chainlink has an absolute advantage in off-chain data.

In addition, the huge off-chain data is also needed by AI. So the explosive growth of the blockchain AI industry in 2024, $Link token will rise in price along with it.

Click “Chainlink Price” to view the analysis of $Link token.

2. Cardano $ADA-based applications

Cardano is favored because it is compliant in Japan and has a partnership with the AI project SingularityNET. The advantage of compliance allows many AIs to consider adopting the Cardano architecture.

Cardano also recently invited Sam Altman, former CEO of OpenAI, showing the ambition of this Layer 1 public chain in the field of AI.

So applications based on the Cardano architecture are worth exploring.

Click “Cardano Price” to view the analysis of $ADA token.

3. Solana

There are many projects challenging Ethereum, but very few of them do it well. Many times, it is just a publicity stunt to challenge Ethereum, and then developers and investors stop after making money.

The purpose of Solana’s founding is also to challenge Ethereum, but Solana is the only Layer 1 public chain that has been continuously working hard since its founding four years ago. From a very small team, it has grown into the seventh-largest public chain by market value. Solana’s developers have also been increasing. Ethereum has about 4,000 active developers per month, while Solana has about 2,000, making it the second-largest developer community after Ethereum.

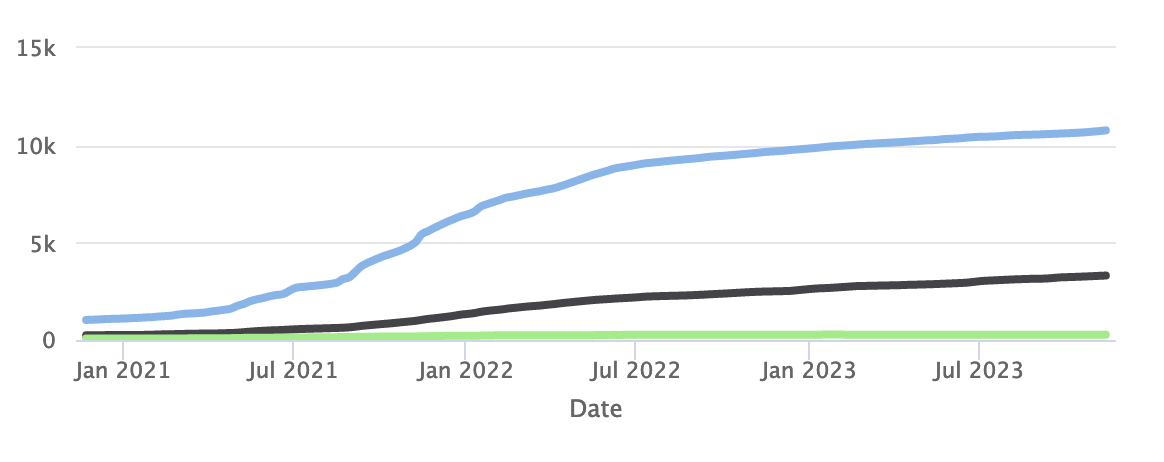

Chart 2: Solana Developers Trend

For Ethereum, Solana is a very strong opponent. In addition to being faster and cheaper in terms of Layer 1 price than Solana, Solana’s development is also very innovative. If Ethereum’s innovation comes from Vitalik, then Solana’s innovation comes entirely from the community.

The development pattern of 2025 may form a tripartite pattern of BTC, ETH, and SOL.

Click “Solana Price” to view the analysis of $SOL token.

Other tokens worth paying attention to

1. Algorand

At the application level, Algorand is simpler and more suitable for beginners than Ethereum’s smart contracts. At the same time, Algorand is popular to some extent because it is faster and has no Gas Fee.

As mentioned earlier, the size of Ethereum’s community is larger, and the application developed will ultimately be used by the community’s users. Algorand has a strong academic background but lacks community support, so its development is relatively slow. In addition, Alogrand was created for Defi from the beginning, and smart contracts are highly targeted. Algorand’s market value is currently 1 billion USD and is worth keeping an eye on.

2. Kaspa KAS

Kaspa is the largest community-based public chain in Israel, introducing both DAG consensus algorithms and POW. Therefore, it is called the third-generation blockchain. There is not much support for applications. Because token distribution is in the form of POW (POW is a distribution method recognized by many communities), the price has risen all the way, reaching a 100-fold increase. As mentioned earlier, the difference between public chains and Meme tokens is that Meme tokens cannot generate applications on the chain, and the common point is that community support is required.

So KAS tokens are also worth paying attention to. The token price is currently retracting.

Summary:

The bull market in 2024 is the pinnacle of blockchain development, with AI development as the symbol at the application level. Public chain development has matured, and in terms of data, Chainlink dominates. Bitcoin’s ecosystem lags far behind, which also means it has the most explosive potential. Deploying Meme tokens on Ethereum is no longer popular, and what will lead Ethereum’s development in this round of the bull market is Bitcoin’s ecosystem.

The above content does not represent any investment advice, and investing in cryptocurrencies carries risks. Users who incur losses from investing in cryptocurrencies need to take responsibility for themselves. Before investing, please do your research.

References:

Strohm, C. (2023, 11 21). US seeks more than $4 billion from Binance to end criminal case – Bloomberg News. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2023-11-20/us-seeks-more-than-4-billion-from-binance-to-end-criminal-case

Chen, J. (2021). Maintenance-related concerns for post-deployed Ethereum smart contract development: issues, techniques, and future challenges. springer.