What’s MongCoin MONG USDT Token? Price Prediction

June 16, 2023

How To Do Argent NFT Airdrop? Starknet Airdrop Interaction Guide

June 26, 2023What’s Optyfi? OPTY Token Investment Research Report

Table of Contents

1. What’s $OPTY Token

OPTY token is the governance token of OptyFiDAO. It has been confirmed that 3% of the tokens will be allocated for airdrops, and the airdrop campaign is currently ongoing. Interested users can follow the official Twitter account at https://twitter.com/optyfi. The airdrop campaign has reached its 8th week, so even if you missed the airdrops in the previous 8 weeks, it is not a significant concern.

2. What is OptyFi? Its main feature?

Liquidity mining in DeFi is a highly profitable aspect of DeFi, but the investment management complexity in DeFi is significant, which discourages many retail investors from participating. Liquidity mining requires investors to switch between multiple liquidity pools (farms), and due to the different currencies in these pools, there can be thousands of strategies to consider. Personal profitability in liquidity mining depends on professional knowledge and understanding of investment analysis. Retail investors, without such expertise and analysis, are prone to losses, even when choosing seemingly stable options like stablecoin staking in DeFi. Examples include the Luna scandal and the collapse of UST.

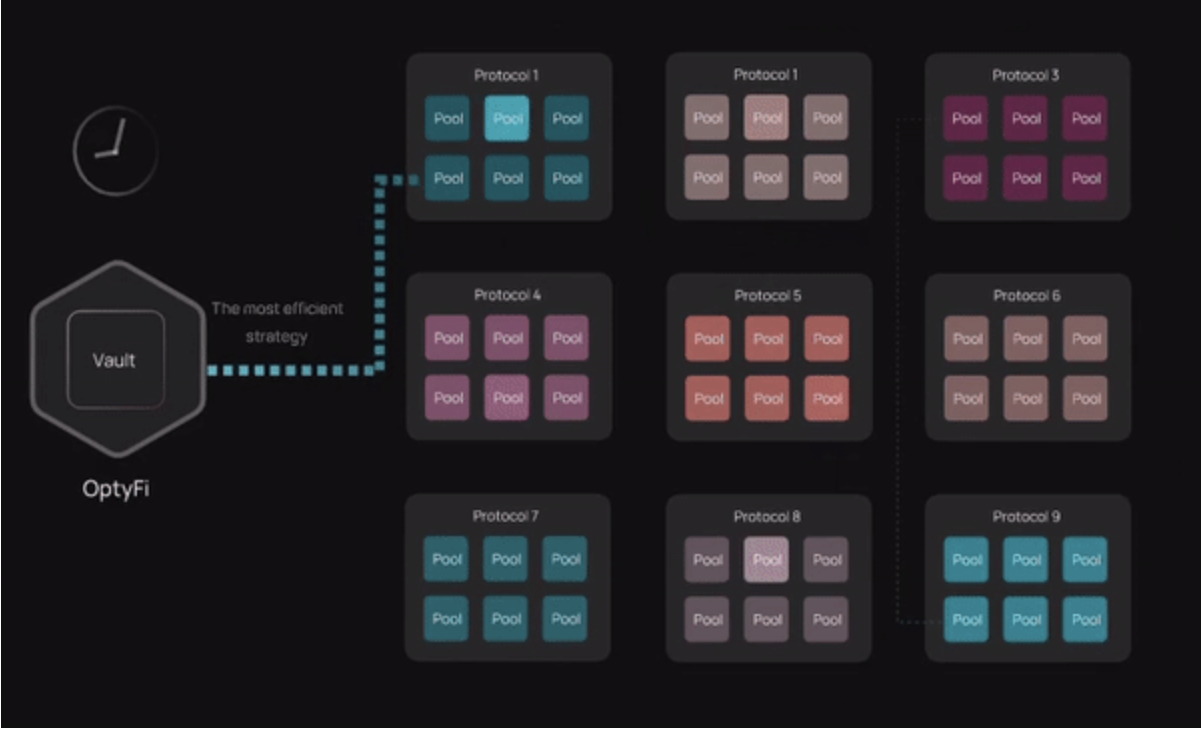

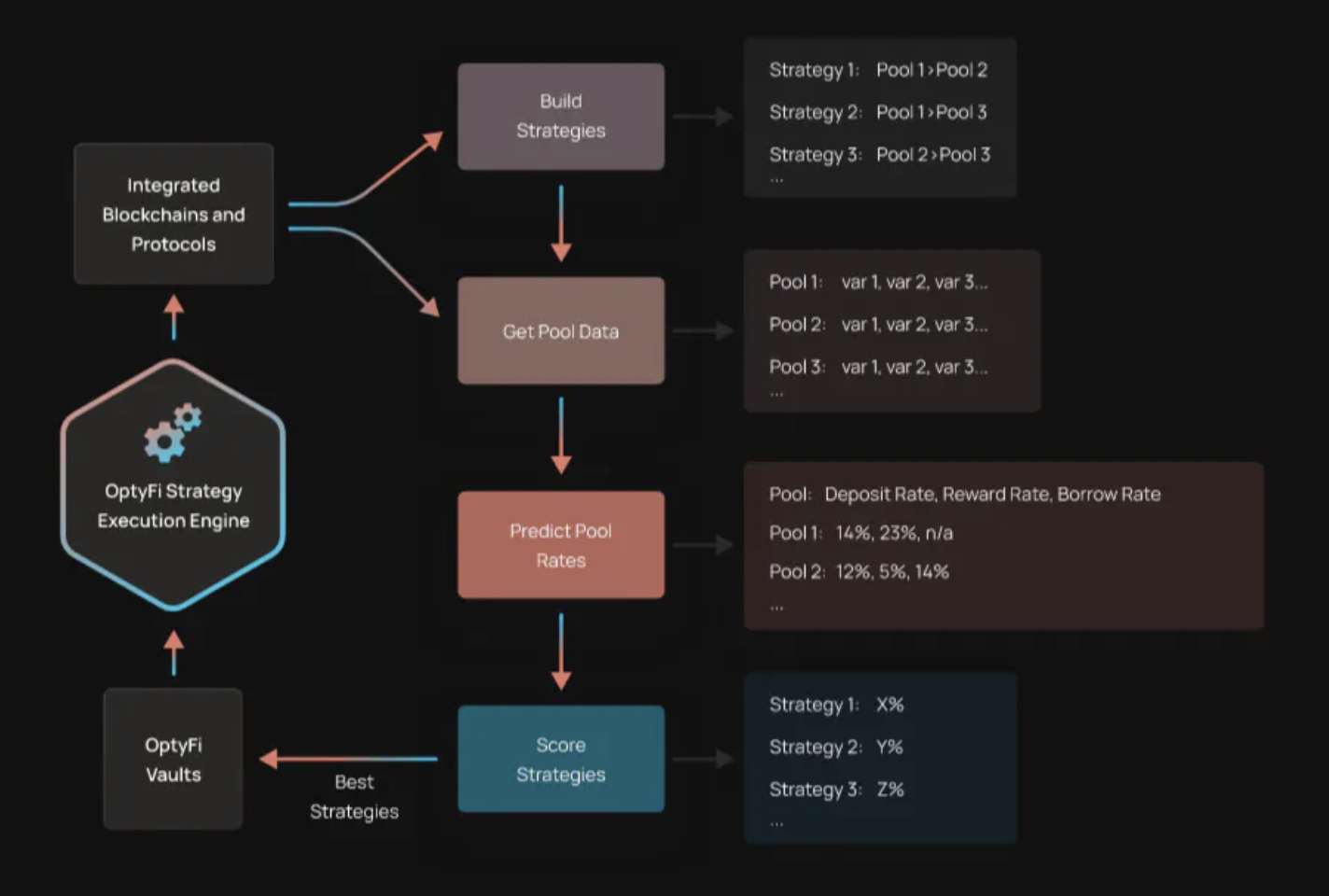

OptyFi addresses these issues by leveraging AI to automatically optimize user assets across more than 1,000 liquidity pools (automated trading). Users only need to set stop-loss points, profit targets, and risk preferences.

Therefore, OptyFi is currently the largest automated liquidity mining platform in the market. The platform consists of two main components: AI and the Opty DeFi protocol. The protocol primarily connects multiple DeFi farms, enabling retail investors to participate in liquidity pools that require substantial capital.

2.1 Retail Investors’ Use of OptyFi’s Liquidity Mining

When optimizing user assets, OptyFi primarily focuses on the following channels:

• Lending pool interest rates

• Trading pool fees

• Yield rates

• Selectable staking options

• Gas fees

Retail investors deposit funds into OptyFi’s vaults to participate in the investment. In this way, the gas fees generated from liquidity mining can be shared among the vault users, and the profits are distributed based on the amount invested. Similar to BingX’s copy-trading product, users need to choose suitable traders based on their risk tolerance.

For users with larger capital, OptyFi allows for custom investment strategies to manage multiple LP.

2.2 What is OptyFi’s Vault?

The Vault is an intelligent contract of OptyFi that operates similarly to a fund manager, managing multiple users’ assets for investment purposes. Due to varying yields in different farms, liquidity mining often requires strategy adjustments to maintain a consistent ROI. However, entering and exiting liquidity pools incurs gas fees, which can lead to losses for retail investors with smaller capital. The Vault pools the funds of retail investors and makes collective investments.

Each Vault is differentiated based on users’ risk preferences and expected ROI. Currently, there are three main types:

Core Vault: DAI, USDC, USDT, WBTC, WETH

LP Vault: cDAI, aUSDC, UNI-ETH-USDT, BAL-OPTY-USDC

Incentive Vault: COMP, BAL, CRV

Each token is combined differently based on users’ risk settings.

OptyFi’s primary investment strategies and meeting different users’ ROI expectations

2.3 OptyFi mainly categorizes its investment strategies into four types:

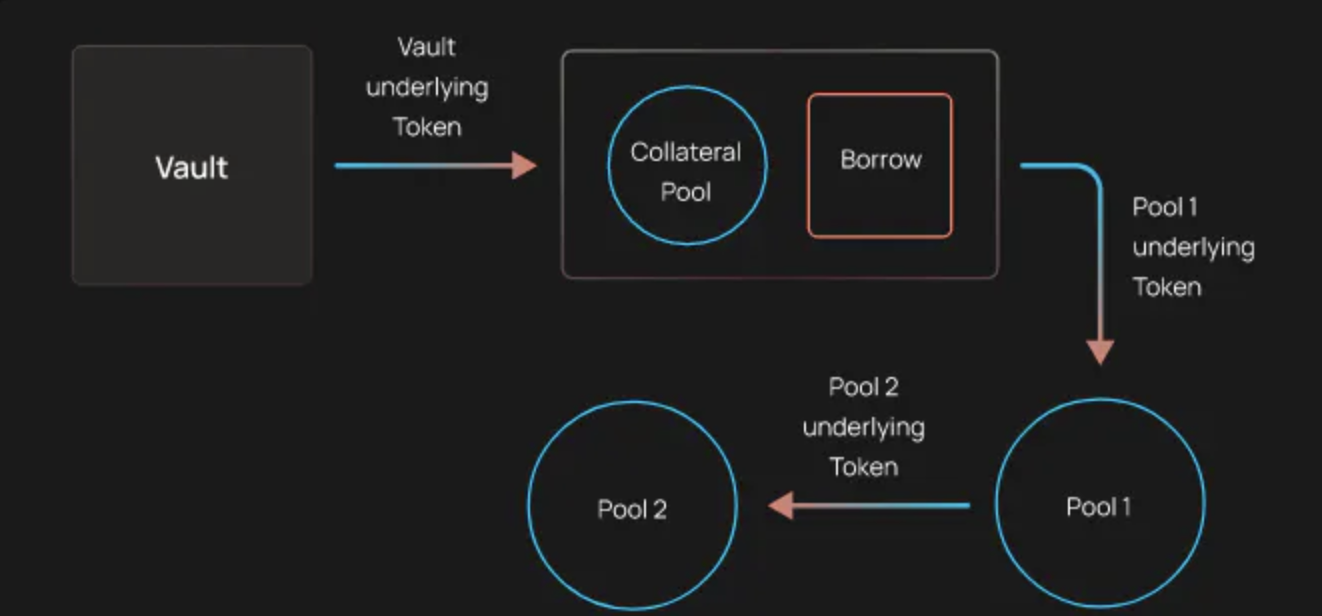

Step 0 strategy, similar to staking. Users can stake Opty tokens or simply deposit tokens into the Vault to earn stable staking rewards from DeFi. The returns are minimal, but the risk is also the lowest.

Step 1 strategy, similar to liquidity mining. The AI invests users’ funds from the Vault into various farms for liquidity mining. The risk increases due to liquidity mining, but so does the potential return. There is a risk of losses.

Step 2 strategy, reinvesting the earnings from liquidity mining into other liquidity pools. It carries higher risks, including the risk of losing the principal.

Advanced Step 2 strategy, in addition to reinvesting the earnings, involves borrowing from DeFi to increase the invested capital. It offers the highest returns but also poses the greatest risk, including the risk of losses that may exceed the borrowed amount.

2.4 ROI estimation and risks of the 4 strategies:

Zero Step Strategy: The estimated annualized ROI ranges from 3% to 4%. It has a lower risk, primarily associated with price fluctuations.

One Step Strategy: The estimated annualized ROI does not exceed 50%. It has a moderate risk and may incur partial capital loss.

Two Step Strategy: The estimated annualized ROI does not exceed 500%. It has a higher risk and may result in a complete loss of capital.

Advanced Two Step Strategy: The estimated annualized ROI exceeds 1000%. It has the highest risk and requires repayment of borrowed funds.

3. How does OptyFi’s AI work?

OptyFi’s AI operates in two modes: fully automated and recommended.

In the fully automated mode, once the user’s settings are configured, no further action is required. However, it’s important to note that high-risk settings do not guarantee 100% profitability. Users need to understand this. For staking, the fully automated mode is the best choice.

In the recommended mode, the system suggests optimized LP investment strategies. Users have the option to choose whether to use and accept these recommendations.

3. OptyFi’s Background

OptyFi is one of the three projects incubated by New Order DAO (NEWO). NEWO assists OptyFi in community operations, marketing, product development, and more. They have also reached a token exchange agreement: New Order DAO will include $OPTY in their treasury, and OptyFi will include $NEWO in the OptyFi treasury.

At the beginning of the year, OptyFi successfully raised $2.4 million in seed funding. The funding round was led by Dialectic, with other participants including Stratos Technologies, Octava, Wave Financial, 0xVentures, and Platinum Capital.

As an incubation of NEWO, OptyFi is also a DAO (Decentralized Autonomous Organization). The governance token of OptyFi DAO not only provides staking rewards but also grants voting rights. The voting power of the token varies based on the holding period. The longer the lock-up period, the greater the voting power represented by $OPTY. Tokens locked up for over 12 months (including 12 months) carry 5 votes, while tokens held for less than 3 months have 1 vote.

4. OptyFi’s Economic Model

The total token supply of OPTY is 100,000,000, with a seed investment of $2.4 million. Token allocation is as follows:

Team and advisors: 28%, locked up for 6-18 months.

Investment institutions: 10%, locked up for 12 months.

User rewards: 50%, locked up for 24-60 months.

Builders’ rewards: 10%, locked up for 24-60 months.

Treasury: 2%, allocated for IDO.

The 3% of tokens allocated for airdrops are part of the user rewards and will have a minimum lock-up period of 24 months. It can be anticipated that there will be a period of price stability after the tokens are listed on exchanges. After 6 months, the team’s tokens will be the first to be released, but the exact amount is unclear. The lock-up period for the team and advisors is relatively short, while the lock-up period for user rewards is as long as 24 months, which carries some risk. In theory, the team and institutions could sell all their tokens and exit, leaving the product in the hands of the community. However, it should be noted that DAOs are not suitable for constantly developing and upgrading products. Financial blockchain products, especially those in the face of increasing regulations, raise concerns about sustainable development.

Please note that the above information is based on the provided text and should be verified with official sources for the most accurate and up-to-date details.

Summary

In simple terms, OptyFI is an AI-powered liquidity mining platform that aggregates various liquidity pools, allowing retail investors to earn money through liquidity mining without requiring in-depth knowledge. The platform adopts a DAO (Decentralized Autonomous Organization) model, which means that it lacks educational resources for retail investors. If retail investors engage in high-risk projects and incur losses, they may perceive it as a platform issue. Therefore, the product is more suitable for users who have knowledge of liquidity mining and are willing to allocate a portion of their capital to try it out. Regarding staking, the entire market’s staking products are currently undifferentiated due to the aftermath of the Luna rug pull, so considering the price surge, the maximum staking return is unlikely to exceed 4%.

The main risks of the product itself stem from blockchain regulations, with the DeFi sector facing increasing regulatory scrutiny. Additionally, the token unlocking period poses initial losses for the team and investors, shifting the responsibility for necessary adjustments due to regulatory compliance onto the community to a certain extent.

Please note that the above translation is based on the provided text and should be verified with official sources for the most accurate and up-to-date details.