What’s zkApes (ZAT) Coin? How To Do Airdrop

May 23, 2023

How To Do Starknet Quest NFT Airdrop?

May 25, 2023What’s SRC-20 Stamp? SRC-20 VS BRC-20 Ordinals

Table of Contents

Introduction:

BRC-20 has driven the development of the Bitcoin ecosystem, particularly enabling NFTs to be issued on the BTC chain without the need for complex smart contracts. The process of token issuance has been greatly simplified. In the Bitcoin ecosystem, NFTs are referred to as “Inscriptions”.

What is SRC-20? How does it differ from BRC-20?

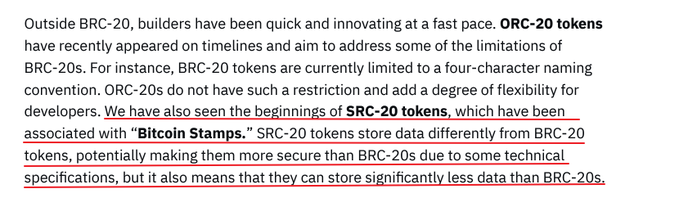

Similar to Ethereum, which had various new smart contracts emerging as successors to address its imperfections, SRC-20 can be seen as an upgraded version of BRC-20. When minting Inscriptions (NFTs) using BRC-20, it triggered debates among some BTC nodes (mining farms with a significant number of mining machines) who argued that such information was meaningless and could choose not to sign it. Consequently, a problem arose where the deployment or minting of Inscriptions could be hindered due to node refusal to execute.

The Oil Ticket protocol of SRC-20 encodes the entire content using Base64 and splits it into multiple P2SH transactions, which are then broadcasted on the Bitcoin network. Since nodes can’t identify the entire content due to the split nature of P2SH transactions, they are required to sign and execute them, making it impossible to refuse. This solves the issue of node refusal to sign, which was prevalent in the BRC-20 Ordinals protocol.

The debate over node refusal to sign also demonstrates that Bitcoin has a certain level of centralization and cannot achieve complete decentralization. Absolute decentralization is idealistic and unattainable. However, compared to other cryptocurrencies, Bitcoin has achieved a relatively higher level of decentralization.

Opportunities with SRC-20:

For investors, the most important factor is whether a project can make money. As cryptocurrencies gradually converge with traditional finance, the profitability of a project depends on two crucial factors: hot money and cash flow.

Hot money determines whether a project has sufficient funds for development. Cash flow determines whether the project is profitable or not. Hot money is the primary factor because it generates FOMO (Fear of Missing Out) and attracts a significant amount of retail investors to invest excessive funds in the project. The result is an increase in the project’s book value and token price.

Currently, the largest token on the BRC-20 platform is Ordi, with a market cap of $170 million as of May 24, 2023. The BRC-20 trading platform, Unisat, has a valuation of $1 billion. The major source of hot money is the acquisition of Unisat by OKX. The first-mover advantage is quite apparent, similar to Ethereum’s NFTs.

SRC-20 still requires significant support as the trading platform is not yet fully developed. Therefore, the project has mainly attracted retail investors who missed the opportunity with BRC-20’s Ordi token. With limited entry of hot money, there is still a lot of caution and observation. Although Binance has conducted an investigation on SRC-20, it does not have the substantial financial measures like OKX has for SRC-20.

Binance SRC-20 Research Report

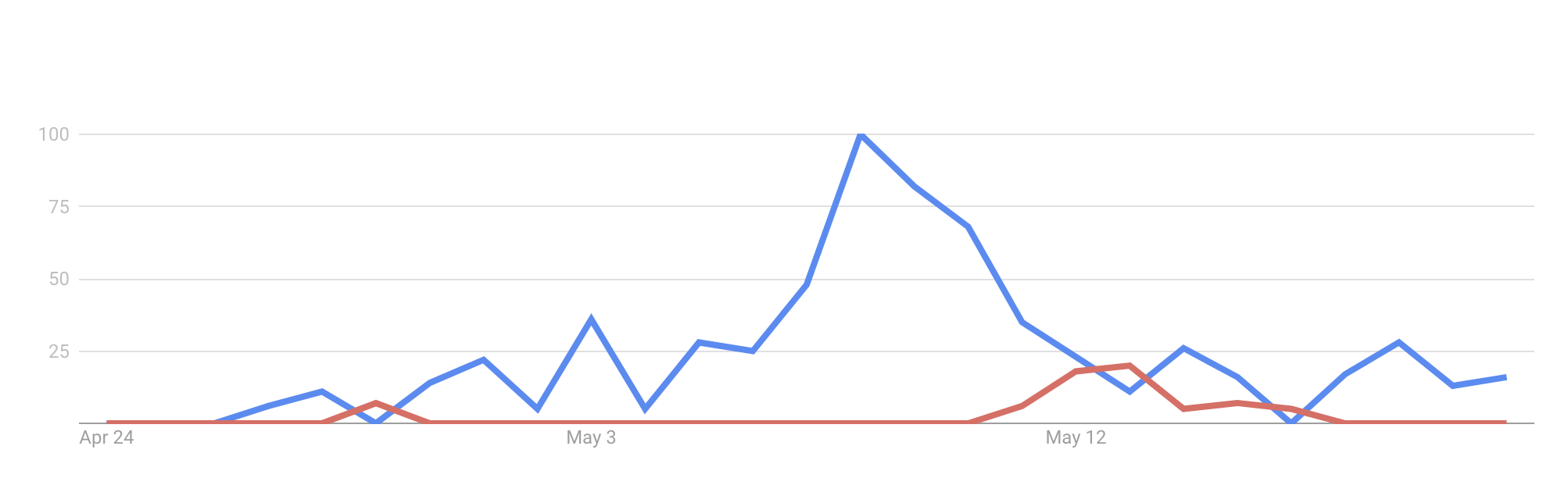

In addition, leveraging the debate with BRC-20, SRC-20’s popularity experienced a slight increase but subsequently showed a clear decline. This indicates that the market still tends towards BRC-20.

BRC-20 VS SRC-20 Google Trend

The ecosystem related to SRC-20:

Wallet: SRC-20 supports the HIRO wallet.

NFT trading platform: ordswap.io.

Mint NFT platform: https://rarestamp.xyz/minting.

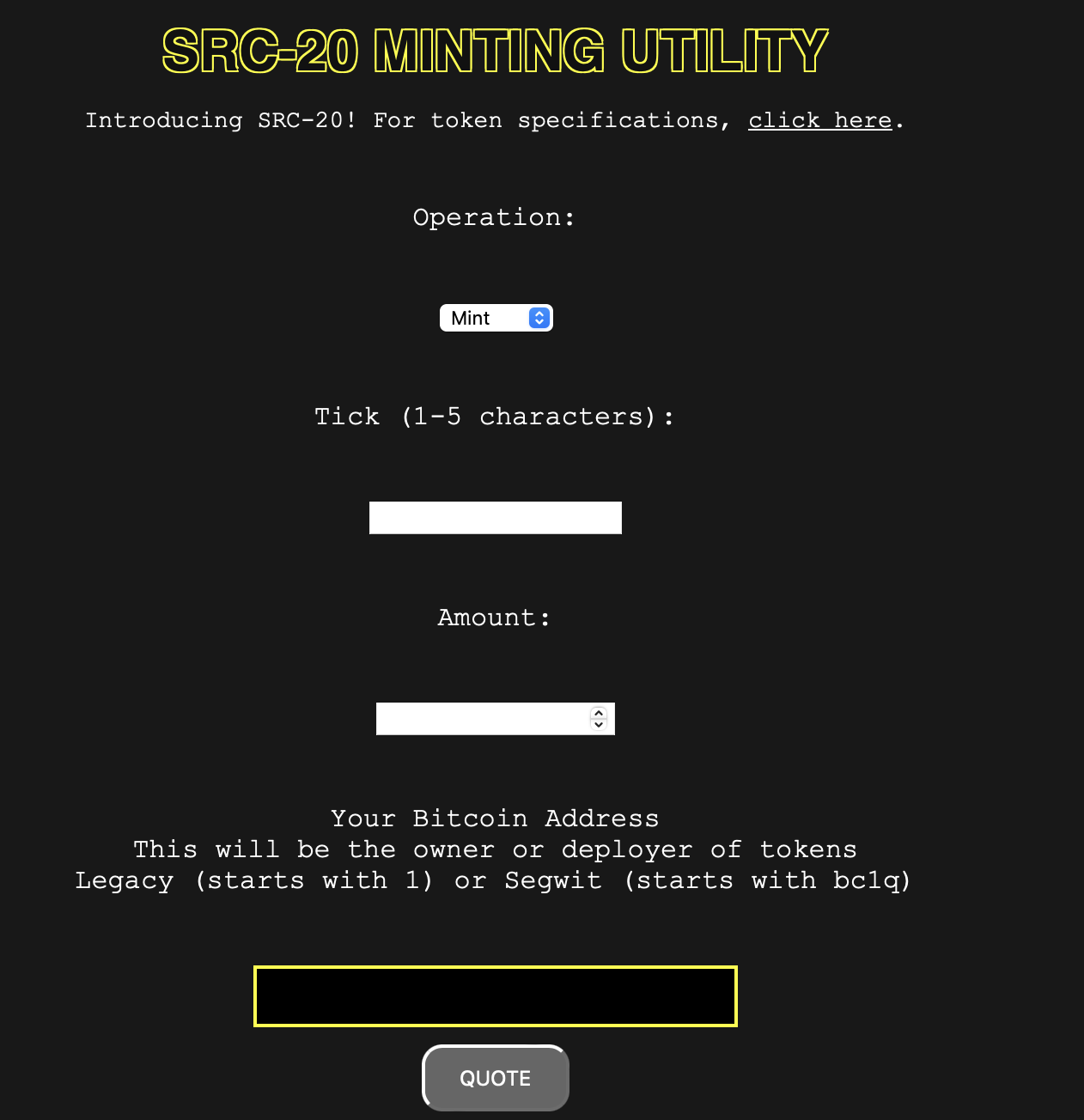

SRC-20 token deployment and minting platform: https://stampchain.io/src20/.

These platforms are still in the early stages, so their user interfaces are not as polished as Unistat. It is also not easy to sell and purchase tokens after minting, such as Stamp tokens. Many users who missed out on acquiring ordi tokens have turned to minting Stamp tokens. It is advisable to check the progress of token minting to avoid excessive minting. Excessive minting not only results in the inability to obtain the token but also leads to Sats loss.

Due to the lack of indications on the official token minting interface, it is unclear whether the token minting process has been completed.

Apart from the lack of displaying token minting progress, there are still various issues with the entire minting process, indicating that it is still in the experimental stage.

The biggest argument between BRC-20 and SRC-20

The main argument between BRC-20 and SRC-20 revolves around whether SRC-20 will replace BRC-20. This question is similar to the debate that arose when BRC-20 was first introduced, questioning whether Bitcoin’s “Inscriptions” would replace Ethereum’s NFT.

The key determining factor for the success of high-tech projects is having sufficient funds, also known as “Hot Money” or “hot money.” With enough “Hot Money,” a project can quickly update and iterate in terms of marketing and subsequent development. This is not determined by retail investors or based on subjective feelings. It is currently the most realistic problem in the Web3 industry.

When retail investors’ funds are trapped, it is because “Hot Money” has exited the market. When retail investors see a doubling of their investment ROI, it is because they entered the market when “Hot Money” flowed in. Unless one has strong confidence in a project and is willing to invest funds in an immature project without considering ROI, only a very small number of users and a tiny portion of capital are willing to take such action in the current market, which lacks “熱錢” and where capital flows rapidly.

If SRC-20 can upgrade on top of BRC-20, it is difficult to say whether there will be ORC-20, ZRC-20, and so on. However, being limited in funds and getting stuck in transitional products will undoubtedly lead to failure. Therefore, in the short term, SRC-20 carries high risks that exceed expectations. If users are interested, they can play around with small amounts like 1 USD or 2 USD, without considering it as an investment. I also do not recommend users to invest in SRC-20.